That’s good and bad news for farmers. Soaring prices define the market for land in Kansas farm country.

Farm real estate and cropland values in Kansas jumped more than 10% this year compared to last year. That’s good and bad news for Kansas agribusiness, largely depending on whether a farming operation already owns land or needs more acres.

“It’s made it more difficult for farmers not only to expand, but for those new farmers to get in,” said Kansas Farm Bureau Director of Commodities Mark Nelson.

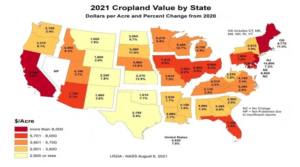

Farm real estate is the value of all land and the homes, barns and machine sheds on a farm. In Kansas, it increased to about $2,100 an acre, up 11% from 2020.

Cropland value saw an even higher jump. It increased 14% to nearly $2,400 an acre.

That’s a higher percentage increase than any of its neighbors. Missouri cropland values increased 7.9%, Oklahoma 7.1% and Colorado 1.6%. Nebraska was close, it’s cropland values increased 13.8% to nearly $5,000 an acre, which is considerably more expensive per acre than cropland in Kansas.

Nelson said the increase can be good news for some farmers. The real estate and cropland value increases inflate a farmer’s assets. That’s an important metric when a farmer needs to get a loan from a bank. It also means more profit if someone decides to sell the land.

But increasing land values also come with a fair number of drawbacks.

Nelson said rising land values could draw more non-farmer investors interested in the land, increasing demand and potentially pushing prices even higher. It also makes it more difficult for a farmer wanting to expand or for a recent college graduate wanting to get started.

This year’s cropland value increase will also mean an increase in the price someone pays to lease cropland in a few years. Multi-year leases typically delay the time it takes for rents to go up.

“A lot of times, if it’s a new farmer or young farmer in the family, they may get a decreased lease rate to help them establish,” said Doug Bounds, state statistician for the U.S. Department of Agriculture.

Higher land values might not have an immediate impact on a farmer’s annual expenses, but higher rent payments will — especially as the majority of farmers lease at least some of the land they farm on.

“It’s one more pressure that’s going to be tightening margins and increasing those break-evens as producers go into 2022,” Nelson said.

He said farmers also worry about general price inflation of everyday and specialty farm goods. The COVID-19 pandemic is still disrupting the supply chains of everything from tractor tires to fertilizer. Nelson said in particular, he expects the price of fertilizer to be double the price in 2022 than it was in 2020.

So even if farmers get a good crop yield and grain prices remain high, the added land and supply costs will likely erase any gains.

“Their break-even costs are creeping up really close to where they are,” Nelson said. “So 2022 could be a tough year for some folks.”

From Brian Grimmett, Kansas News Service.